Accelerate Digital Transformation With Software Testing

- March 25, 2020

- HibaSulaiman

The Role of QA in Supporting Digital Transformation in Banks

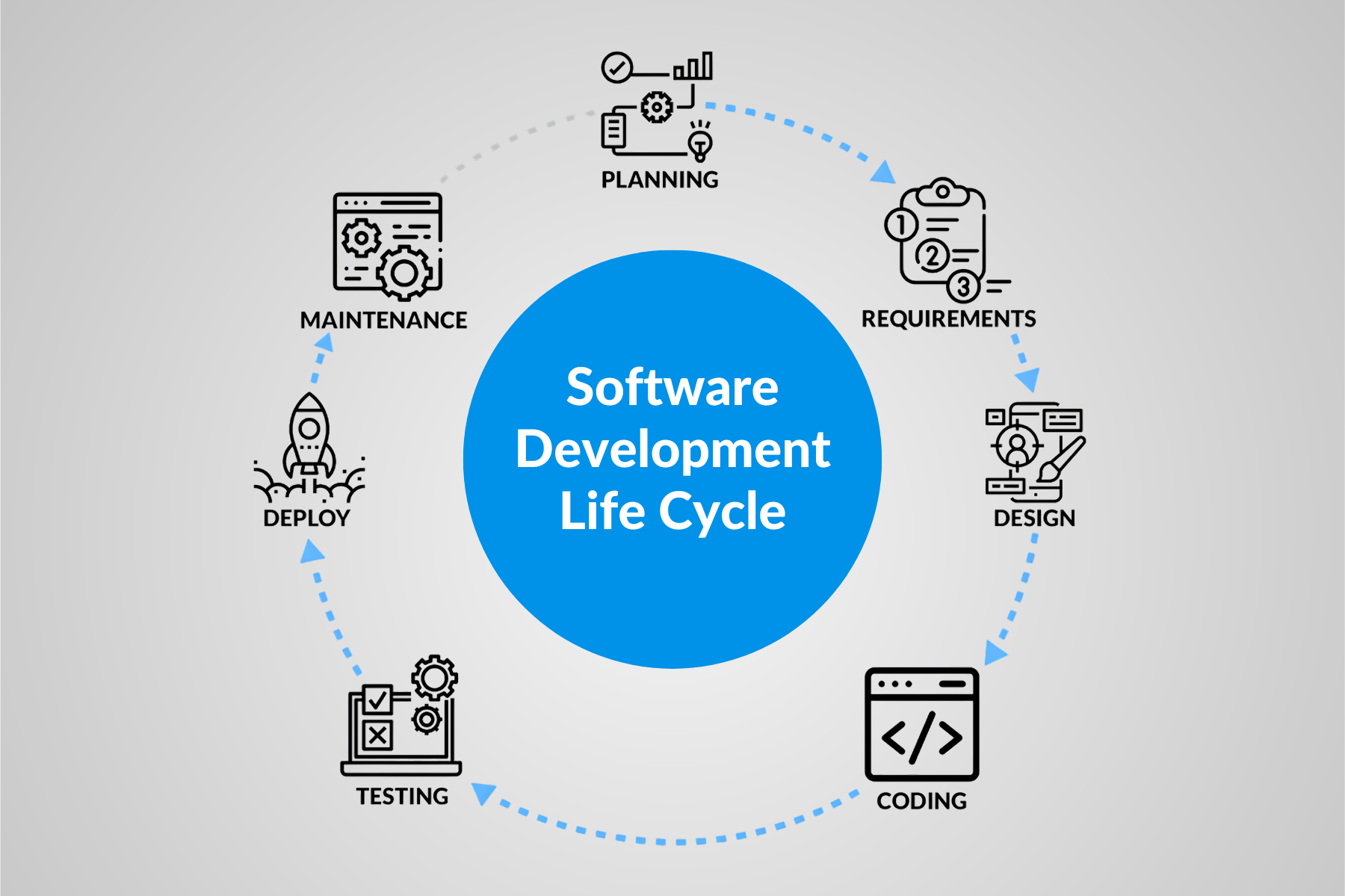

Almost two decades ago, the Agile manifesto changed the IT landscape. Agile introduced faster delivery cycles, focusing on reducing time-to-market and adopting a shift-left approach. As Agile transformed the Software Development Life Cycle (SDLC), it led to the rise of DevOps, another methodology centered on increased collaboration, shorter feedback loops, and breaking down silos. These approaches aim to meet evolving customer expectations and the demand for continuous releases. Today, businesses are undergoing a transformation that requires more than just technological upgrades. Independent software testing companies play a key role in supporting enterprises through this journey.

The Need for Transformation

According to Forrester, “Digital transformation is not just about technology, it’s about reimagining the company.” Businesses today are taking a customer-centric approach to implement strategic changes, ensuring they stay competitive. Transformation can offer improved cost-effectiveness and faster releases. Both Agile and DevOps methodologies are integral to this transformation.

Challenges of Transformation in Traditional Industries

As traditional businesses invest in new technologies, industries like Banking and Financial Services (BFSI) face unique challenges. Bankers accustomed to traditional ways of doing business often struggle with adopting new technologies. Cultural shifts take time, and employees need proper training to use digital applications effectively. Moreover, the sensitive nature of banking data makes it crucial for institutions to rely on experienced and independent testers to ensure a smooth transition to new platforms.

Challenges Banks Face During Their Transformation

In-house teams often lack the testing tools and environments necessary for effective quality assurance. Manual testing becomes time-consuming and costly, making it difficult to ensure a smooth transformation. Without a structured testing approach, the entire journey becomes stressful. It is critical for banks to integrate a sound testing methodology early in the development cycle to address customer requirements and avoid setbacks. Privacy concerns and the lack of proper tools further complicate data management and testing.

The Impact of Cultural Shifts

Resistance to change is not only seen among banking staff but also with customers who are hesitant to adopt digital banking. This cultural shift requires patience and buy-in from all stakeholders. Establishing a culture of change within the organization and fostering customer adoption are key to ensuring success.

How Agile and DevOps Drive Transformation

Both Agile and DevOps methodologies are essential for successful transformation. With continuous testing integrated into both approaches, businesses can optimize their workflows and drive quality throughout the development cycle. To achieve this, businesses should focus on three core principles:

- Streamlining workflow in one direction

- Shortening feedback loops and improving communication

- Embracing experimentation to learn from mistakes and refine future processes

These principles help maintain speed and quality while meeting customer expectations, making them invaluable in supporting transformation efforts.

Introducing TCoE (Testing Center of Excellence) for Quality Assurance

In today’s competitive world, consumer expectations are higher than ever. An independent testing company can help banks implement a Testing Center of Excellence (TCoE) to oversee all their digital offerings, from mobile apps to websites. By conducting thorough QA assessments, these teams ensure products are user-friendly and meet high-quality standards. The adoption of Agile methodologies in testing further supports smoother transitions from traditional banking to modern, digital-first services.

Simplifying the Transformation Journey

Banks are continuously investing in technology to become competitive in the global market. Moving to paperless and branchless banking requires careful planning and execution. Agile methodologies help banks integrate new systems with minimal disruption to their ongoing operations. Through well-planned change management strategies, banks can achieve digital transformation with fewer complications.

Conclusion

Enterprises aiming to succeed in transformation must always prioritize the customer experience. Keeping customers at the center of each decision, strategy, and initiative will lead to a more successful transition.

Just like in a DevOps environment, the shift to digital requires both cultural and procedural changes. From executives to QA testers, everyone within the organization must understand how their roles are evolving and what new responsibilities they will have. Identifying and addressing resistance early can help streamline the transformation process.

As businesses continue to embrace the cloud, open-source tools, and APIs, they must close any gaps by leveraging skilled resources capable of handling these complex shifts. In industries like BFSI, transformation requires not just technology upgrades, but a fundamental change in mindset and culture.